Benefits of dual occupy investments

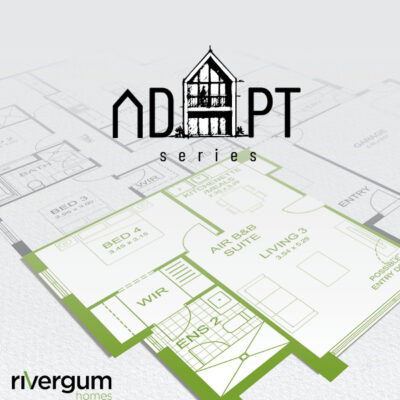

Rivergum’s Adapt series gives a more cost-effective alternative to granny flats as an innovative way to invest within this booming rental market. Whether you are looking to build an investment holiday or long-term home, the Adapt Series offers two homes under the one roof with a standard family home plan and attached apartment style residence within the same footprint. Some benefits to dual occupied investments include:

Two rental incomes with one set of fees

If the larger home and the additional attached residence is both rented, you will receive 2 incomes but with 1 property to manage. This means only one body of council rates will be payable and two income producing properties on one title.

Rent one and live in the other

Renting out either living quarter and living within the other means that someone else will be contributing to your mortgage and easing the pressure significantly or providing a second income without many rental fees.

Often attract high amounts of depreciation

This is because there are almost double the kitchens, laundries, and bathrooms with two self-contained homes within the one building. The wet areas usually cost more to maintain because there is plumbing work and tiling (referred to as division 43) and plant and equipment within these areas such as dryers and dishwashers (known as division 40). When calculating the return on investment, the one set of fees paired with two tax deductible homes makes for a great investment.

To view the Adapt range brochure with floorplans and more information, click here.